Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

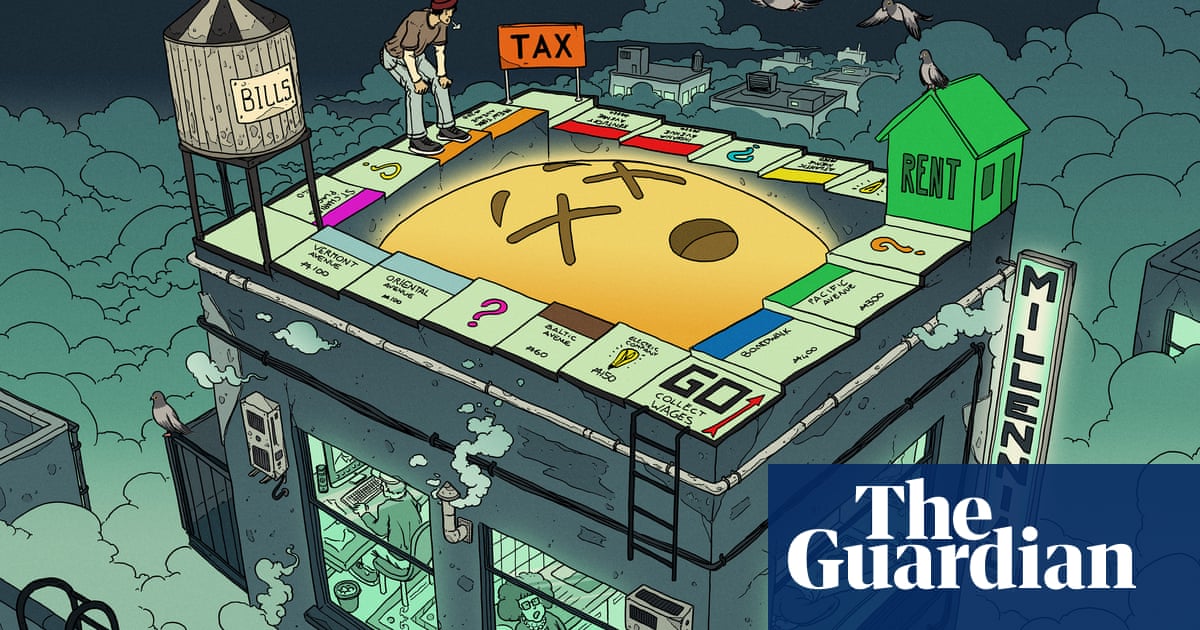

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Good post, but we really need to get out of the generational thinking.

I know rich and poor boomers. I know rich and poor millenials, and gen X/Z.

It’s a class struggle. Always has been.

Stop making it a generational battle. That only serves to divide the working class.

Yes, there is racism, ageism, sexism. We should debate those things and improve, but we can’t let those things divide us politically.

And since I’m ranting, let me end with a solution. We need to find themes that help all of us.

So perhaps we should say: for example, everyone with less than $1M in wealth gets a $20K tax deduction.

Who could oppose that? It doesn’t benefit home owners vs. renters. It doesn’t benefit students vs. retirees. It doesn’t benefit city dwellers vs. rural. Or white vs. black.

But it does benefit the class who owns nothing and gives them a better chance to own something.

So perhaps we should say: for example, everyone with less than $1M in wealth gets a $20K tax deduction.

As long as you a) have a robust enforcement mechanism (otherwise it will just be another PPP scenario), and b) offset that tax break with new taxes on the wealthy.

Good post, but we really need to get out of the generational thinking.

I know rich and poor boomers. I know rich and poor millenials, and gen X/Z.

It’s a class struggle. Always has been.

As I said somewhere else, it is not that boomers are rich. It’s just

allmost rich are boomers.TIL Taylor Swift and Elon Musk are boomers.

Replaced all with most.

That’s better.

But most rich people are old, that’s not new.

That’s just how wealth accumulation and inheritance works.

That’s the thing. “It’s a class struggle. Always has been.”

Who could oppose that?

I think you know who… there is one class that seems to go FAR out of their way to control the conversation to the end of “there is no class struggle” (or even “there is no such thing as class”?).

Electoral reform is needed to do away with First Past The Post voting so people can be free to vote outside the two party system with no spoiler effect.

Stop making it a generational battle. That only serves to divide the working class.

That’s difficult when a lot of the news media is owned by *checks notes… the Capital class… and they have vested interest in keeping the conversation about a generational battle.

But yes, 100% agreed. The problem is we’re all commenting on news articles that will never stop presenting it that way.

Someone else could write news then? People started doing that on YouTube - e.g. CPG Grey, Ian Danskin/Innuendo Studios, Hank & John Green, Jon Stewart, Bill Maher, Kurzgesagt, etc. It did not work out well I think, especially since people seek more immediate gratification i.e. Twitch dances or whatever rather than fully college-level subject matter provided entirely for free, oh except having to watch ads for the corporate overlords.

If we do not value i.e. take care of things, we will lose them. In this case - and here I will use a generational term, b/c it refers to the only people in charge at the time it occurred - the Boomer (+ Great) generations chose this for the legacy of everyone who came after. Which is only the history of how we came to be here, but it is our choice to continue forward this way.

Someone else could write news then?

Well exactly, it’s an uphill battle, sadly. I’ve been upset at how weak our media has been since the Bush years, when I was working in local television for an NBC affiliate. I got to see all the behind the scenes of the beginnings of the War on Terror and how much our media purposefully pumped up both the war in Afghanistan and in Iraq and how they helped promote the outright lies of the Bush administration. It was eye opening as a twenty-something to say the least and made me incredibly distrustful of government overreach that was being exhorted by patriotism and nationalism. “Spy and snitch on your fellow Americans to prove how patriotic you are!” It was also part of the beginning of dropping the facade of “racism being over” because holy fuck did brown skinned immigrants all get put in the “dangerous radical Islamist” basket, no matter their real nationality or religion. It deeply colored my view of mainstream media as consistently right-wing, even back then, because of how often they would capitulate to Republican lies to support wars intended to enrich a small elite.

I’ve been wanting to see more independently successful media organizations most of my life, but most of what I have seen is media consolidation, and it’s certainly not like I have the capital to get into the business myself. It’s brutal.

Finally, just as you said, we’re competing with Twitch and TikTok and a lot of these issues really require text documents and references that can be checked more easily than needing to sift through a three-hour-Youtube-video of the issue. The problem is we’ve raised a generation that really doesn’t want to read much at all if it isn’t a subtitle for a video. That’s… distressing. (But not to act like it was much better in my generation, it’s not, it’s part of why we have so many shitty kids: their shitty millennial parents who shove a phone into their hand like Boomers shoved us in front of TVs.)

I wouldn’t even know where to start on how to fix it. I’m with Marshall McLuhan, we’re spitting out new communications mediums before we’ve even really understood the social impacts of the previous mediums. He argued we still didn’t understand writing and we had already jumped headlong into radio and television… Well, look at us now baybeee, shit’s spiraling with the internet, McLuhan. Maybe he’s spinning in his grave to match.

CPG Grey

CGP Grey right?

Seriously the best content creator I’ve ever witnessed. His video on First Past the Post voting should be mandatory to watch.

So tired of people thinking inside the world’s smallest box, the two party system.

It did not work out well I think, especially since people seek more immediate gratification i.e. Twitch dances or whatever rather than fully college-level subject matter provided entirely for free, oh except having to watch ads for the corporate overlords.

I can’t completely agree with it. There are a lot of college-level-only channels. From English youtube I know only The Efficient Engieneer(engieneering), Thought Emporium(molecular biology, close to popsci), Marco Reps(engieneering), Breaking Taps(engieneering, close to popsci). From popsci Veritasium(mix), Practical Engieneering(engieneering), numberphile(math), computerphile(applied math).

From Russian youtube I can only think of popsci mixed with college-level: Ekaterina Shulman(politology, mix), Chemistry - Easy(chemistry, mostly college-level). From popsci: Physics with Pobedinsky(physics), SciOne(multiple hosts), QWERTY(multiple hosts, originally was about astronomy), Alexandr Panchin(biology), Vert Dider(mix, only translated from english), Artur Sharifov(mix).

Perhaps I am being unfair with my language, so here’s an example if it helps clarify: this is a video combating vaccine disinformation campaigns. It is cute, slow paced enough, but also keeps moving fast enough, it aims low but at the same time it contains high levels of content, and basically answers anyone’s questions about the situation. It is as perfect a video as I think can possibly exist - extremely bold words, but… accurate imho? Edit: oops, this is the one I meant, but notably the fact that there are multiple that fit this criteria also serves a different point as well!?:-)

However, instead of watching this, more people died in the USA from the pandemic than from all wars combined, and like so many other scenarios (e.g. gun violence) we will forever be ignorant of the true numbers because we are actively prevented from counting them.

This is literally, actually, full-on life vs. death, but people cannot be bothered to watch even so much as a 10-minute video to save their life, or the life of everyone around them including their entire family. And the nation that they claim to love and be patriotic for.

Knowledge can easily cure ignorance, but not much if anything can be done about obstinacy. Maybe if they suffer enough pain they may finally start to care enough to open up to listen a real answer, but brainwashing is so tough to attempt to break through.

That channel also deals with climate change, technology, etc. But to switch to a very different example, another one is the rise of fascism all around the world. Ian Danskin’s Innuendo Studios has a playlist for his series on The Alt Right Playbook that is as comprehensive and deep a collection on that topic as I have ever seen. One example of the series is I hate Mondays and another is There’s always a bigger fish. These in some ways are more important than knowledge about climate change or vaccines or gun control or whatever, bc it discusses what we as a society will do about those matters. But instead of watching such, and/or even reading the Constitution that they claim to love, people instead show up at the White House with the idea to literally behead people (January 6), and on the other side liberals always seem shocked, Shocked I tell you, SHOCKED!?! at the actions of conservatives, despite how remarkably consistent they are.

With so much free, virtually instant knowledge (okay so less than an hour?) available to us all, and with an ad blocker needs nothing at all in return but even without one having to watch a handful of ads is nothing in the grand scheme of things - with all that is available, I can only conclude that people do not want that knowledge. i.e. people in both sides - liberal and conservative - remain in their ignorance by choice, bc it’s easier to watch something akin to a TikTok dance.

It is cute, slow paced enough, but also keeps moving fast enough, it aims low but at the same time it contains high levels of content, and basically answers anyone’s questions about the situation.

That I call Kurzgesagt popsci, not college-level. Not that their video lacks research, just I think such format is not collage level. I consider even this(has autotranslated subtitles, I recommend watching) to be popsci.

Examples of scientific videos: 1, 2, 3, 4, 5.

Examples of engieneering videos: 1, 2, 3, 4, 5(closer to popsci).

Examples of popsci: 1, 2(well, scientific journalism, but close enough), 3, 4.

Knowledge can easily cure ignorance

“Knowledge is the light in the darkness of ignorance”.

bc it’s easier to watch something akin to a TikTok dance.

Sometimes clip formats bring up discussions about society and culture too.

Yes the purpose of Kurzgesagt is pop-sci. Hank and John Green are more college level (remember: American college is often equivalent to high school elsewhere in the world) and the likes of Innuendo Studios and CGP Grey can get fairly far away from dancing and deeper into philosophy.

The reason I brought up Kurzgesagt was that even that level is beyond what people want to see.

(remember: American college is often equivalent to high school elsewhere in the world)

Really? Are there any examples? I like laughing at America for not having healthcare, but I don’t think education can be that bad.

The reason I brought up Kurzgesagt was that even that level is beyond what people want to see.

This is very saddening.

there are a whole class of humans that actually think; ‘i had to suffer through student loans, everyone else should also’

The word “think” is doing a lot of heavy lifting there… plus how many conservative voters these days even have college degrees? The TV (or radio) man says to vote one way, so they do, end of the matter as far as they are concerned. (extraordinarily sadly, no /s on this one)

weirdly, its also older people who prolly paid <5k for their entire education whining about people getting ‘handouts’.

Exactly ^this. It makes sense to them that they “worked their way through college”, ignoring how that is no longer possible.

Tbh I’m not a fan of just handing out money to the predatory banks who screwed students over with those loans either, but damn we should do something. Like maybe educate ourselves on a topic prior to banning people from doing it, possibly, hopefully?

And then they go and say “that’s not how democracy works”, except when you win the majority so hard that you even overcome the electoral college effect then they simply overthrow democracy itself.:-(

There are indeed real facts, and real people, behind all those pithy sayings.

My wife has a job with an awesome pension and as a result there is basically no situation she will ever leave. I pointed out to her that the golden handcuffs are still golden.

One day some MBAs are going to learn that if you don’t want constant turn over you give workers a pension so great they would crawl over their mother’s corpse to get it.

What am I saying? MBAs learning? Hahaha I love being silly.

deleted by creator

Unfortunately, living in the US, I would not take a job with a pension because the (private) pension system cannot be trusted. I remember the 00s when many company pension accounts went bankrupt, because companies were no longer offering it as a benefit and it was easy enough to screw over retired past employees. Companies would take poorly performing divisions and their pension plans, spin them off as a new company that would quickly file for bankruptcy.

I would not trust a pension without it being insured by an organization like the FDIC. Even then, I would be afraid that my pension would not cover living costs due to inflation.

Luckily there are alternatives. I have a 401k, which should give me a steady flow of inflation proof dividends… until a market downturn wipes it out. If that happens, I can fall back to Social Security. Don’t believe the baloney that the government will ever let Social Security go bankrupt. They will just cut down benefits.

I don’t deny things like that happened. You heard about them right? So did I. But that’s the thing, these are the stories you heard. It’s man bites dog, it is observation bias.

Also her pension is insured. And I am pretty sure the bankruptcy thing you mentioned was one particular case with a car part maker.

I searched what MBA actually means. Fuck that shit. Degree in “Business Administration” sounds like degree in praying. Wait, there is one! Fuck!

One day some MBAs are going to learn that if you don’t want constant turn over you give workers a pension so great they would crawl over their mother’s corpse to get it.

Plus, modern MBAs see turnover as a good things because it makes the short-term investors happy.

Wtf why?

This is an appropriate reaction, in my opinion. Modern economic philosophy is entirely myopic with no apparent perceived value in anything beyond the next quarter. From that perspective, if your employees have already created value and you’ve budgeted more than severance would cost (or think you can get away with constructive dismissal), then, for the quarter, getting rid of employees looks like a financial positive.

Sociopathy, lack of long term planning skills, drugs (metaphorical and physical). Some combination of those I suspect.

For some, you get the Jack Walsh thinking that some employees are going to be statistically bad performers, so it is good to get rid of them.

You also have other cases where lowering the time to train means you can expand faster since you don’t need to find quality staff. The original McDonald’s trained its staff to be able to be high output restaurants. The business model changed to needing less worker training to help fuel expansion.

You also have the case where some managers believe some jobs only require a commodity level labor. At that point, there is no value in training.

So tired of hearing that shitstain’s name. I admit there is some wisdom to the up or out approach. You know for very very high level workers. Like C-suite or a rank below. Doing it across the company just promises misery and failure.

Wasn’t there a study that said MBAs don’t have object permanence nor a real conscious understanding of the passage of time?

Money today. That’s all these businesses understand.

It doesn’t matter if any specific MBA learns a lesson. Some other douche canoe will swing by and have their single brain cell fire off just this one time and they’ll start hacking away at the pensions to make Q3 look better.

Boeing style.

No more moon shots, contract out everything, slash pensions, fight a war against your union, move corporate away from production, buy your own stock.

I’m a late gen-Xer (born in '80, so I’m more of a “Xennial”). I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire. I feel horrible for all those who are in a worse financial situation than me, but we are all really fucked in the next 20 years.

I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire.

If this is your reality, there’s more wrong with your expectations than your situation.

Social Security is set to run out in the 2030s, and I fully expect the stock market to crash, effectively wiping out my 401k. As others have mentioned, resources like water will start to become scarce, inciting instability.

SSI isn’t set to run out. It will have to be reduced if they don’t take the income cap off of it, however.

But all the other things you said will happen.

SSI isn’t set to run out. It will have to be reduced if they don’t take the income cap off of it, however.

that’s as realistic as single payer healthcare; or universal basic income; or sensible gun control legislation; or abolishing the electoral college, they all have super majority support of everyone in this country but there’s too much monied political interest against ever allowing it happen.

Exactly. SS is too popular. There will be some sort of reform/funding, but congress will wait to the least minute to fix a problem. See any sort of continuing resolution government funding bill or the last time SS had problems back in the 80s. The '83 reform only occurred a mere months prior to insolvency. The fact that SS is still years/decades from major problems means it’s someone else’s problem to our elected representatives.

The one thing you can count on conservatives paying attention to is messing with their money.

What happens might not be pretty, but if they try to day “fuck it, guess we are ending the program” there will be hell to pay.

Nah. They’ll be happy that minorities are hurt too.

With enough propaganda anything is possible.

It will probably happen once the cut triggers. You are going to immediately see a lot of angry voters.

Considering how one party is hellbent on getting rid of social security and the other party just shrugs and let’s them get what they want; id expect the shrugging party to be left holding to bag and suffer the political consequences once the cut hits with nothing happening

Correct. IIRC there’s an auto mechanism that will cut all benefits by 23% or something. So you’re mom/dad getting $2,000 a month would now only get about $1,500.

and I fully expect the stock market to crash, effectively wiping out my 401k.

You only lose money if you sell. Those who were able to stay the course after '08 made it all back and then some.

The risk is a huge crash right before you retire, or you have to pull from your 401k to fund living expenses.

I think the fear is it stays crashed. Like a new paradigm takes over that is hard to plan for

Well that’s a silly fear.

If you think the stock market crashing wipes your 401k to 0 and that’s realistic you need to get your head checked.

In 2020 it only dropped 20% and bounced back within 3 years.

Where do you chicken littles come from? Lol

Invest in water you say…

That’s very pessimistic.

Not for the entire southwestern United States. There’s 5 major cities off the top of my head getting ready to face a zero day. If you don’t think the stock market is going to react when that happens…

What’s a “zero day” in this context?

Zero day is the day a city runs out of water and must literally truck it in.

Gotcha, thank you!

I call it realistic. If you think everything is going to work out, you’re delusional, man. But I hope you prove me wrong some day, I really do.

Yeah, I’m not going to live my life like that.

i want to live like you; what evidence to you use to shore up this viewpoint?

deleted by creator

Jumping in here with a couple cents. Background: Old millennial, paid off home, pension, 401K, 6 figs. I’ll be able to retire. My viewpoint: Automation and AI will accelerate. “Safe” jobs will be gone. In fact most jobs will be gone by 2029 (my guess). Goal: keep working and investing until I lose my job.

Hard times will hit because government is slow and wealthy people won’t care until it affects them. Once jobs are cut, profits for many businesses will fall because no one will be buying anything with the money they aren’t making. As big companies begin to fail, stocks will have already begun dropping. Wealthy will go after government and government will have to do something. Only good option to keep things running: Universal Basic Income. Question is where does the money come from? Answer: AI/robots will be taxed and taxed almost 100% more than a human. Why? They won’t care.

This leads us into humans have free-time to do whatever they like. Some can work where AI/robots fail for whatever reason, some can create new things using all the new tools. Businesses will still try and make the best products so the wealthy can still feel better with all the money that really won’t matter as much anymore. They’ll enjoy some exclusive things but it will likely be just locations and not technology.

TL;DR: Hell at first, then modern day renaissance.

No evidence. I just choose to live with a positive world view and not like every day is doom. I face problems head-on when they appear and I don’t collect sorrows in advance. But you do you. I know my approach is hard for most people.

Same exact boat. Zero confidence I can retire. My best case plan is to move to South America at so. E point and hope I can make it until I die.

Weird flex, but ok

He’s lying.

I’m almost exactly same as you and you’re full of shit.

If you’re honestly making 100k with no debt and one mortgage around 300k you can save 2k a month if your wife makes a decent wage.

Who said they have a wife?

Am millennial… xenniel or “elder millennial to be exact… I have completely given up on ever owning a home or being able to retire. Short of some major acts of public disruption at unprecedented, economy-toppling, billionaire-eating scale, my entire generation - and those after us - are fucked.

And yet we act like boiled frogs, each generation making fun of the prior one for expecting things to be better than they are. Gen z is so used to things being like shit that they think that all older generations are entitled fuckers And that we should get used to everything being worse because Right now it’s the best they’ve ever known.

You only need like 5% down for a home. Zero if you are a veteran for some reason. Mortgage is almost always cheaper than renting.

Unfortunately, this age-old folk wisdom just isn’t true any more.

Near Los Angeles (and many/most big cities these days) even “fixer-upper””starter” homes cost $1,000,000.

5% down ($50k) would result in a monthly mortgage payment of $7,939.88 which more than twice my rent payment, which is already high.

And saving is nearly impossible given the rate at which the basic costs of living (including rent) have skyrocketed in recent decades.

It worked for me last year. Put 5% on a home near a major city, purchase price $425k

Some areas like LA are just a special kind of fucked, but you don’t have to live there.

The lesson here is do the calculations for your area. There are a lot of “buy vs rent” calculators online.

Yeah, I bought fairly recently (as interest rates were starting to climb) and it was 100% a qol decision rather than a financial one. I’m paying more in interest now than I was paying in rent before, so instead of giving my money away to a landlord, I’m giving it away to my mortgage company.

The only way I’ll come out ahead financially is if the value goes up. But I have mixed feelings on that, too, because the housing situation is fucked here and value continuing to go up will mean that the situation is still fucked. I don’t want this place to be my home forever, so if the price here goes up, then the price of better places will also go up and it ends up being a wash until I don’t need to own and can sell, but even that would be tough because inheritance is probably going to be my daughter’s only way of ever owning her own place.

Or, on the other hand, if they fix the housing issue here by limiting the number of residences any person can own and barring corporations from owning at all (or at least not having them count as new people for number of places they can own), then prices will crash and most people who currently has a mortgage will end up owing more than their house is worth and will still be fucked in that way. Unless the government makes the banks eat some of that or does a bailout for homeowners.

But anything in the above paragraph would probably take a revolution to actually happen because all of these bugs for regular people are features for those that have the wealth to influence the political power.

Or best option, rather than a crash we massage the housing market into stagnation for a decade or two with a combination of increased supply and gradual regulation. Stagnation in housing prices will over time let wages catch up.

Even at 425 PMI is killing you to the tune of an extra 300/ month

$61/mo actually.

Zero down also for USDA home loans

LOL I’m never retiring. I’ve already accepted that I’ll be working until I’m dead. There are those who get dealt the right cards and will get to retire comfortably. I’m just not one of them.

Now try being a mid 30s millenial that couldn’t even make it running a business

For real. I’m over here having a mid-life crisis since I was 27.

That was your “quarter-life crisis”. Don’t worry your mid-life crisis is still on its way :D

Goddamn right, I thought the quarter was rough, I was wrong

i felt like that at 28 after my 3rd layoff, i’m in my early 40’s now and still feel this way and wish the article had something to share besides describing my life using other people as an examples.

Running a business is way harder than just being a worker. I don’t understand what you mean by this.

in the article someone with a successful business is worried about home affordability and retirement. elsewhere someone with an unsuccessful business is worried about both of those things plus the business bleeding money. I’m referring to myself. I ended my so called business, quitting while I was behind because there is no getting ahead of the explotative big players without drowning in stress and never having time to relax or enkoy life.

Aw shit I did the classic reddit thing and only read the headline. Sorry, that’s my bad.

I do that all the time too.

For the last 10 years when I’ve been asked about my career goals during job interviews I always respond, “I would like to retire.” I then clarify that I don’t mean tomorrow, next year, or even 5 years down the road. I just don’t want to die a wage slave.

What’s the typical reaction to that? Bring honest like that doesn’t sound like a winning strategy, unless you pass it off as a joke maybe.

I don’t say the wage slave part outright like that. I say the part about retiring with a smile like I’m joking but then use the opportunity to point out that I think about and plan for the future and that I’m financially responsible. Then I ask about the company’s benefits package.

Covid made thing weird for a while but my career has had a generally upward trend. My current job is a pretty serious step up for me in both salary and benefits and has a pretty clear path for future progression. I lost out on some of the creativity that I enjoyed in prior positions but I gained more free time to engage with my hobbies.

I’d say it’s been working for me but your mileage may vary based on your delivery and what kind of job you’re interviewing for.

Hell. Gen X also are worried about retirement.

Will social security be here in 15 years? My 401k has not kept up at all… Everything today costs soooooooo much there’s no real room for saving.

Right??

Early Gen Z / very tail end of millennial here.

Got a job that pays ~80k (with promotion potential to 100k in a year) and I’m just… dumbfounded at how yall are making it. I didn’t grow up wealthy at all, and struggled with homelessness for a time, so I’m not new to the frugal game, but being able to put away only a hundred or two bucks a month after taxes is crazy with the hours and time I put into existing. I’d rather just not work at all if the end result is the same.

Doordash is a crux in my life and something I’ve definitely splurged on in the past, but groceries are just as expensive outside of rice beans and chicken. Baffling. :(

being able to put away only a hundred or two bucks a month after taxes is crazy with the hours and time I put into existing.

Every little bit helps. Future you will thank you for even putting that amount away.

I try, but of course life finds a way to rip whatever savings I’ve got slowly but surely.

At this point, I’m still looking at working till the day I die.

Most recent social security trustees report says the trust fund will run out in 2035. What happens in 2035? Benefits are still funded at 83% in perpetuity. By the way, last year it was going to run out in 2033, and the year before that it was going to run out in 2031. And also by the way, the trust fund was specifically set up because they knew the baby boomers were going to stress the system, so it’s supposed to get depleted as the boomers use it.

Everything is working mostly as intended, and yet there’s all this anxiety around Social Security. Why? Because Republicans want you to think Social Security is fucked all on its own so that you don’t question it when they ratfuck it. That and they want to constantly frame the conversation as such so that the conversation doesn’t turn to “how do we make social security more robust and generous?” or some other radical socialist nonsense.

What do you invest your 401k in?

X’er here. I have what most would consider a good job, with good pay, and a good boss. I consider it a good job with good pay and a good boss. My spouse is unable to work, and we have two children. I’m currently seeking some skill or product I can develop without taking time away from my existing responsibilities such that I have a chance of not having to work until I die at my desk one day.

With no shade against millenials, this is the only time I’m grumpy about being forgotten in the generational sniping that goes on. All these articles (like OP) about this very valid angst from older millenials and I identify with it pretty much every time. I know I’m not the only X’er who does.

X too, steady job, ok pay, lucky enough to have bought a house before COVID, but not enough to save thousands of $ for retreat.

I have noticed that the titles of many articles, yes even at The Guardian that generally has good content once you get past that, are written to generate maximum clicks.

You were not ignored by accident. It was a calculated decision to maximize profits, in a manner that controls the conversation and leaves you out in the cold.

Fuck corporate greed:-(.

But for you, my fellow human being who isn’t a hollowed-out shell i.e. CEO, I wish the absolute best outcome possible. (And me too.)

Maybe house prices will go down someday? I really am genuinely surprised at all that Biden('s administration) has managed to accomplish, but it was set back years before it even started by the pandemic, greedflation, and other economic and other forms of unrest. If we can get past this next election without a literal and actual bloody civil war… well then most of us will still die of climate change (gee, I am just full of positivity today aren’t I? sadly, that is the most positive take possible on that one:-|), but we might be able to make some headway? e.g. start incentivizing building houses further away from city centers, which WFH should help make possible - and even if you want to live in a city, the decrease in demand should help lower prices?

Anyway, all we can do is what we can do (aka not everything is within our control), so don’t stress too awfully much about it. We’ll die - we can’t change that - but hopefully we’ll have some good days between now and then:-).

not having to work until I die at my desk

Lol this guy thinks there is a chance he will die at his desk. I wish I could feel that optimism.

Chances are better that at best you will die in gig or part time job like Walmart. The most likely is in you kids house, really yours but you will give it to them, and without medical support beyond basic hospice.

Many of your peers and friends will die in homeless camps or from police violence.

You were jacking off when you wrote this, weren’t you.

It’s the trouble with attributing it to any specific generation. It’s like people forgot that Gen Xers grew up reading the same dystopian sci-fi that we did that predicted this corporate shithole world. Neuromancer was written in 1984, when I was three years old. People forget that the cynicism of Gen X explicitly came from being such a small generation compared to the Boomers that it was just always a given that they wouldn’t ever have much political influence. Hell, it even affects a lot of Boomers, because this has been going on for a long time.

Gen X gets forgotten, but they were honestly the first to really bear the brunt of this disease that’s eating at all of us, and thus it’s sad that they get forgotten. Cheers mate, and I hope you find that skill and succeed in your goals.

Thanks buddy. 🥹

I leave this parting gift…

I’m grumpy about being forgotten in the generational sniping

Every generation grows up, settles down, and starts quarrels with its parents.

In 10-15 years, Zoomers will remember you.

Lol!

No.

No.

But one day I will get so desperatly poor that taking out someone in siphoning wealth from the country and ending them might seem like a fitting end.

If we don’t change things anyways.

I always wonder why people shoot up schools and parks when their problems are caused by people in board rooms. Never see a mass shooting in a board room for some reason.

Maybe there’s a selection bias, and we only hear about the dumb ones who target innocent people and get caught.

Believe it or not, people willing to murder others aren’t the best at thinking clearly.

“Those who make peaceful revolution impossible will make violent revolution inevitable.”

- John F. Kennedy

Let’s make peaceful revolution possible by campaigning for electoral reform at the state level! We should all be free to vote for those who best represent us, secure in the knowledge that our vote will still be cast against those we don’t want in office.

We don’t need to wait for trump to have a hamburger heart attack, we dont need to wait for the republicans to stop existing. We can do this right now… and some states already have!

Yours can to, most especially the blue states. Who is stopping you in those blue states?

You won’t retire, no. No longer work a job because everything is slowly falling apart as our climate apocalypse trudges on? Sure, but you’ll still be working hard to survive.

she has about $75,000 saved up for a downpayment

Oh you poor child. That’s not even close to enough. 💀

It is tho. 75k gets u closed on a 300k house with 20% down basically

It’ll get somewhere just north of half a million.

So a two bedroom condo. Probably not what most people had in mind for that much work.

Yeah that’s about it where I am but in other places that’s a 2b/2b house with a half acre yard, which isn’t horrible.

I guess that means you can add on to the house. Like one of those shanty towns.

This is another one of many things that the government should be taking care of for people (and they sort of tried to with Social Security) but of course the “privatize everything” sociopath elites killed that idea, and our culture expects everyone to just learn how to Warren Buffet better. Bro, do you even index fund?

deleted by creator