- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

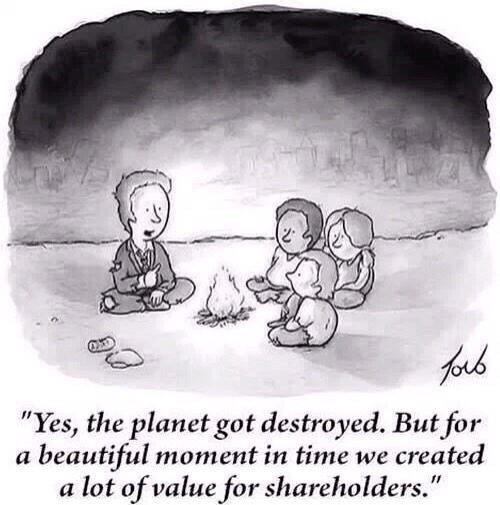

The circularity isn’t equal. OpenAI has promised $300B to Oracle (it doesn’t have) in fees/sales of Oracle services. Oracle is buying $100B from Nvidia fees/sales. Nvidia is investing $100B in OpenAI conditionally, but supposedly for OpenAI to pay for separate datacenter GPUs.

So Oracle stock pumped by $300B in value. it will never get the revenue, and the profit could be 0 even if it did. The weak link in the “circle” is definitely OpenAI. ChatGPT is not the best model. Very poor at coding, with MSFT switching to Anthropic. Megacorps cooperating with US military with datacenter approach is a bad idea, and local secure LLM at 10 tokens/second has better value than the mega models. Mega model datacenters are about Skynet as a goal.

That’s half of the economy right now. Trillion dollar companies trading bundles of cash between one another.

No cash is being moved.

Wheres that scene from rick and morty with the aliens shoving linkler into each other

Two economists are walking in a forest when they come across a pile of bear shit.

The first economist says to the other “I’ll pay you $100 to eat that pile of shit.” The second economist takes the $100 and eats the pile of shit.

They continue walking until they come across a second pile of shit. The second economist turns to the first and says “I’ll pay you $100 to eat that pile of shit.” The first economist takes the $100 and eats a pile of shit.

Walking a little more, the first economist looks at the second and says, “You know, I gave you $100 to eat shit, then you gave me back the same $100 to eat shit. I can’t help but feel like we both just ate shit for nothing.”

“That’s not true”, responded the second economist. “We increased the GDP of the forest by $200!”

I feel like this is basically what happens to half of the GDP generated by the US healthcare system. There’s a shit ton of complex rules around payment, so insurances companies and providers basically jerk around with a shit ton of money while everyone gets fucked.

The punchline ignores the real reason they did it for humourous effect, making it funny but not illustrative.

Checkmate, libtards.

They’ve added $300 billion to the GDP

Repeat as many times as you want.

Infinite GDP glitch

Which is exactly why GDP is so stupid as a metric of economic health, and precisely why it’s the primary indicator of economic health used by our government.

Because it’s bullshit they can point at and talk about how great things are while the real economy is breaking down around us.

IFIWEREARICHMAN

TRADITIONINNOVATION!

rosebud; rosebud; rosebud; rosebud; rosebud;

!;!;!;!;!;!;!;!;!;!;!;

I feel old for getting this reference.

deleted by creator

They’ve also (hopefully) paid their due taxes on that.

Define “due taxes”? It’s all a net loss bc “we” paid so much in nontaxable stock options to our senior leadership so they could borrow more money and buy a 2nd plane to get from their private island to their new boat.

Starting with US taxpayer money. #scam #americanEducationIsNumberOne

The Red Dwarf episode?

This shit is gonna crash so hard our grandchildren will learn about it in school.

I hope we still have schools by then

I don’t remember how long ago I first saw this one, but I am deeply grateful it’s still making the rounds every time I see it.

I hope humanity is still around by then

When is that? In the year 2525?

I shall endure and rage to thine descendants about the folly of economic incest!

i’m doing my part to accelerate this collapse, by taking whatever liquidity i can out of the system for myself. have extracted my yearly salary in just the last 2 month alone, just by buying calls and puts (practically zero risk, i don’t dare short stuff when everything is so massively overpriced)

soonwe i am 100% financially independent the sooner i can dedicate 100% of my time to undermining this abomination we have created in the states

my plan is to spam the overloving shit out of affordable, high quality, high density housing anywhere and everywhere i can (forcefully urbanizing this country, and undermining all rent-seeking parasites)

I have no interest in finance but I have a big retirement account. Can you explain how to do this so I can help too?

to keep is simple, as I don’t know just how much you know (and I’m still very new myself tbh)

it’s all purposefully complicated with obscure rules and exceptions, all specifically meant to trip up new “players”, breaking some in the wrong way can land you in prison, while a slight variation might be perfectly fine.

what helped me the most is understanding just how truly rigged the whole thing is, and what helped the most there was a book called Reminiscences of a Stock Operator, everything in it applies frighteningly well to modern day markets even though it was written over 100 years ago.

the biggest most important lesson is…look at everything like a scam designed specifically to extract as much $ from you as possible (which, is especially in low overall-trading volume levels like now, is 100% true. that’s fundamentally what bubbles are, people deliberately running the price of stocks up). it’s a zero-sum game, in order for you to gain someone else has to lose.

whether that’s bonds, stocks, futures, whatever.

but…there are 2 very fundamental rules that always reassert themselves eventually.

-

the true value of the underlying security, and if a company doesnt pay out a dividend…that means it’s stock is functionally worthless

-

the line MUST go up/down eventually

the more of a disconnect between those 2 things there is, the more someone who knows 1 can take advantage of someone who only thinks in terms 2.

and the best way to do that (for plebs atleast) is…exercising stock-options. the US market, contrary to…literally every other market on earth, has this little rule that allows you to exercise options early.

so for example, say someone sells you a put option on SPY 3 years out, strike…780. right now that’d cost about 12,500/contract to buy. if you bought that and SPY dropped under 655 anytime in the next 3 years…you could exercise it immediately for a profit.

right now spy is 658…a 3 point drop between now and 3 years out…that’s practically guaranteed. free $.

but when someone executes those contracts on you, if you don’t have the underlying, 1 of 2 things happens…you start paying your broker interest to borrow the underlying (at an ever increasing rate) or they forcibly close your position, which if your over-leveraged enough means…you get liquidated.

the issue is though, in a bubble, when everything is overvalued…how to do you safely play the casino without owning the underlying?

-

The ancient craft of making bubbles.

Isn’t cycling around kind of what money does though, just generally with a lot more links in the chain?

Yeah lol I love the sentiment of this meme but the understanding of, and I don’t even want to call it economics… The understanding of the fundamental nature of scarcity, and human cooperation and collaboration, that this displays…is disappointing.

We could make the same meme about any organized exchange of human energy, even without any money.

"I spend 10 hours harvesting potatoes.

I give my neighbor the potatoes, saving him ten hours of work.

My neighbor uses his extra 10 hours to fix my roof."

This is just like…the literal nature of reality. Energy is transferred between different subsystems within a system, according to how much the subsystem is capable of demanding or receiving energy. This could be funnier if all the companies were owned by one larger company, but even then it wouldn’t be a particularly deep insight. That would be the same sort of thing as a family member gifting you $100 for your birthday and then you gift them $100 for their birthday later in the year. At the very first glance it seems circular and pointless, until you realize that you’re basically temporarily allocating additional resources to someone for them to use for a certain amount of time, and then reallocating them to someone else at a later point when you no longer need that surplus.

It’s actually quite reasonable as a principle. The fact that the particular instantiation of this principle in the case of AI technology may be fruitless and not socially beneficial is NOT an essential flaw of the principle but rather an incidental flaw in the principle’s actualization in this particular case.

It should be, but presently it accumulates in the assets/accounts of the 10 worst people you can imagine instead

The peers are supposed to move different things around, not sell the products in one direction and send the money back to play again.

yeah it’s called “velocity of money” in economics terms. the US currently expects each dollar bill to change hands around 110 times a year.

deleted by creator

A portion will end up going to employees

Another portion will end up in the governments pocket

you never heard of trickle-down economics?

in this case it’s like a bunch of billionares cirlcle-sucking each other dicks, and on occasion when one of them garggles on too much cum that he cannot hold in his mouth, it’d trickle down to his employees as bonus or whateverDijkstra will settle this

How do I insert myself in this triangle?

meme of guy pointing at a butterfly

Is this the time velocity of money?

deleted by creator

Not give, but signed a $300 billion deal to purchase cloud compute power from them, which will be filled with Nvidia cards.