I know this is just a meme, but I think it’s an important clarification: The rule of thumb is ~6 months’ worth of expenses, not salary. It really is important to hold you over in case of sudden job loss, since it takes most people 3-6 months to find a new job (but it doubles as a fund for genuine emergencies too, which can save your ass for stuff like unexpected medical or vet bills).

But unfortunately, lots of people live paycheck to paycheck, so for them, a month’s worth of expenses is the same thing as a month’s salary…

It gets worse than that. Many of us have expenses that are higher than our income.

I was going to say, until roughly 12 months ago 6 months of expenses would have been more than 6 months of wages for me.

Hell, still is if all I’m counting is my own income, and not household income

I’m friends with a woman who makes six figures. She’s always broke. She lives in a very expensive part of the country, but she always has to go to every big show. She travels all over the world, at least two major vacations every year plus smaller in country trips. She’s got a bedroom in her (rented) house with no bed, the whole room is for her clothes and jewelry. Blows my mind. No savings. She’s in credit card debt. If she’d just chill for six months she’d be so set.

Sounds like she is enjoying life, but that stops at the credit card debt. Thats just dumb.

You’re right. I’m not from the USA and I’m not living paycheck-to-paycheck, but having ~6 months of expenses as savings is manageable. That depends on your situation, income, number of children, of course. Will be problematic when you’re earning in the lower income brackets, but for most people that should be a little bit under 10.000€ here in Germany.

I call it Cadillac Advice. I was telling someone I was looking for a used car when I was like 17, and had a part time job, clearly still a kid. And they told me they had heard this and gave me the valuable advice of how to find a Cadillac dealership. I didn’t even know how stupid this advice was as a kid. I was just confused. Like ‘I guess this guy’s so dumb he dosen’t know what a used junker car is. Weird’’ anyway, I bought a Pontiac T-1000. Which you’ve never heard of or seen because that were all recalled a few months? Years? After they were originally oftered to the public. An old guy I didn’t know had one in his garage somehow, totally forgot about it for a few decades, then died. His wife wanted me to clean out the garage for a few bucks. I took the car as payment. Believe me, she made out like a bandit. That car nearly killed me a good few times. And the $50-$75 dollars I used to fix it up was a total loss.

T-1000

nearly killed me a good few times

Hmm…

Have you seen this boy?

More realistically, 3 months of expenses, not 6 of salary. Maybe go higher from there if you’ve paid off debts and stuff.

It’s unfortunately very difficult to achieve for many, and impossible for some. But if you can, you absolutely should have an emergency fund.

Some people can but don’t, either due to lack of financial education, lack of impulse control, or feeling they have to spend a lot to be happy.

Shit happens in life, from a broken boiler or car to a job loss. If you can, please build an emergency fund.

More realistically, 3 months of expenses, not 6 of salary.

it’s the same picture

Like I said, it’s difficult for many and impossible for others.

No the key is to have a minimum wage job. That way you only need $7k

Honestly though, you only need 6 months of necessities (housing, sustenance, and things needed to find another job or travel to supportive friends or family.)

It is good advice if you can save the money. One of the things I learned when I was desperately poor is you must lean on your community of other poor poeple. Trading favors is how we survived. If my friend didn’t have enough for food we fed them. We worked on each other’s cars. We had to live close to each other because we didn’t have gas money or reliable transportation. It sucked.

Now that I have escaped the poverty trap and have an emergency fund, it’s like I’ve activated a cheat code. Everything it easier when you have immediate money.

Once you’re out, reach back in. (You probably already do)

Give things away on Buy Nothing groups. Offer your car fixing services or what you can.

Did your friend find success too? Are you still friends?

A few of them, we are still friends, and they did find their own success, but most of them I have no idea what happened after I moved away. A lot of these friendships were born of necessity and only surface level.

I declare bankruptcy

Isn’t it supposed to be expenses not salary? That’s what I’ve been told at least.

Yeah the salary thing was the wedding ring bullshit.

When Your living paycheck to paycheck, it’s the same.

My old coworkers spend all their money, which is mental imho.

Had a guy there that bought a new pc for €4k and then he ended up being between jobs so he had to borrow money from his dad.

I know we all wanna have some fun, but with such big expenses you gotta keep some buffer…just buy it 2 months later to be safe.

I think he misunderstood what a 4K capable PC is

This always felt like banker advice to me. That’s an insane percentage of cash to have sitting in an account that’s earning less interest than the rate of inflation.

I would suggest everyone have a stock investment account and not worry about the percentage. Setting aside $1 per month is infinitely better than $0.

The goal of an emergency fund is to be available for an eventual emergency. If you lose your job and need to live on saved up money for a few months, you might be forced to sell stock at the wrong time, losing capital. There is a middle ground where you invest that money in a low-risk investment product that will grow with time, without the volatility of the stock market.

To be fair, 6 month is a lot, and most likely not the first goal someone should have when it comes to personal finance starting from zero.Indeed. I think 3 months is reasonable too, that’s more than enough time to find another job. And you can leave it in an easy access savings account so it makes a little interest

This always felt like banker advice to me. That’s an insane percentage of cash to have sitting in an account that’s earning less interest than the rate of inflation.

First, if you’re getting less than 3% on your savings account rate, find a better bank (or even better a credit union).

Second, you will find that there are times in life when having cash you can lay your hands on immediate solves problems that nothing else can. An extreme example: if you need to get bailed out of jail or retain a lawyer right now, the stock you have in your portfolio is going to take more than 24 hours to liquidate and get transferred into your checking account you can pay the court or a bondsman. More than likely its closer to 48 for the market to open to close your position and perform a wire transfer to get the cash in your hands. A less extreme situation may be a desperate car repair or a dental root canal.

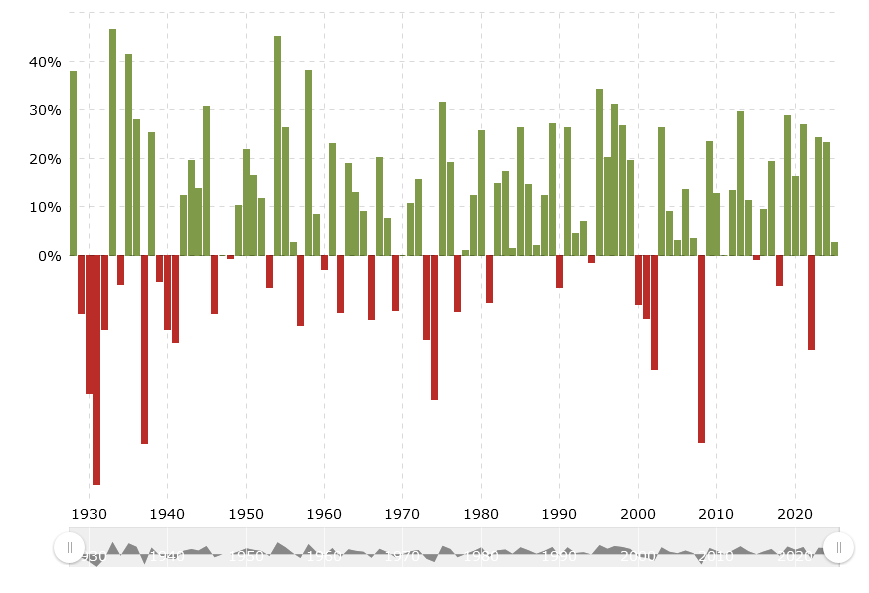

Lastly, you really don’t want your emergency money in volatile stocks. Even an boring S&P500 index fund is a bad choice, why? Because there are times of financial crisis that can drive down the value of your stocks or mutual funds. Its entirely possible that is the time when you’re going to need cash to float on. Selling at the bottom of the market in a crisis is a bad place to be. This was many people’s situation in 2007/2008 during the financial crisis where the market tanked the second worst in US history, and people were losing their jobs left and right.

S&P500 returns over the last 100 years:

All those red years would mean your desperately needed emergency fund is worth a fraction of what you put into it.

Those graphs make it look scary but clearly the stock market had trended upwards. If you’re using your emergent fund within a year or two of putting the money in, I would argue it’s not an emergency.

Bail is a weird thing to be planning for and I don’t think you have the timeline right on how quickly bail is set.

But my main point was to simply put money aside at even the smallest amount rather than make excuses.

Putting it in an investment account rather than a savings account sitting right next to your checking account is too easily to access. The withdrawal delay can be a feature.

The balance of the emergency fundis not something one should be seeing or thinking about as often as one sees and thinks about their bill payment account.

Even if one is only comfortable using a saving account, I would still suggest using a separate financial entity.

Everybody needs to be ready to get bailed out if they can. Shit’s gonna get weird here.

Those graphs make it look scary but clearly the stock market had trended upwards.

I don’t disagree, but if you’re needing money in a emergency, you don’t have the luxury of waiting weeks/months/years for it to trend upwards.

If you’re using your emergent fund within a year or two of putting the money in, I would argue it’s not an emergency.

I don’t understand that logic at all. The very definition of an emergency is that it is unplanned for, and you can never know when it happens.

Bail is a weird thing to be planning for and I don’t think you have the timeline right on how quickly bail is set.

I’m not planning on bail being needed. I’m using that specifically as an example specially because no one plans for it, which is the point of an emergency fund.

But my main point was to simply put money aside at even the smallest amount rather than make excuses.

You and I are in complete agreement on this point.

Putting it in an investment account rather than a savings account sitting right next to your checking account is too easily to access. The withdrawal delay can be a feature. The balance of the emergency fundis not something one should be seeing or thinking about as often as one sees and thinks about their bill payment account.

YMMV, I don’t necessarily think this is true for everyone, but I concede it likely is for a portion of the population. I admit this can be a valid point.

Even if one is only comfortable using a saving account, I would still suggest using a separate financial entity.

I agree with this too. One other emergency that can happen is your banking credentials being breached/identity theft, and it will take some time to sort out. If you at least have a second bank where your E-fund sits, you can live on that while your primary gets sorted out.

This always felt like banker advice to me. That’s an insane percentage of cash to have sitting in an account that’s earning less interest than the rate of inflation.

The advice is to have access to your funds, you’re free to put that anywhere you like. Index funds, bonds, stocks etc

Check what options are available in your country.

Doesn’t putting the $$ anywhere that’s not retrievable miss the point of having an emergency fund? It’s supposed to be liquid assets you can spend if you had to. Putting it anywhere with good returns would keep it from being available at 11:45pm on a Saturday night when the ER is demanding payment now or they won’t treat you.

That’s what credit cards are for. You have a while to cash in your investment and pay the bill.

Although things are so uncertain right now I’m considering pulling all my savings out of the market. I know the stock market isn’t real, it has a good chance to even go up. But I think we’re heading for Great Depression part 2 if all the threatened tariffs happen.

that’s what high yield savings accounts are for

No one has increased their wealth because of savings account percentages. If that’s where the majority of your funds are located, you’re wasting the money’s potential.

I wouldn’t bother giving this advice if it was the same boring play it safe guidance. People who are risk adverse have options that need to be talked about and it’s not going to be found in your local banks pamphlets.

People are really bad at measuring risk. Choosing to avoiding direct investments is one such case.

Consider putting $20 in stocks per month instead of $20 on lottery tickets per month and see the difference. I assure you the former has better results than the latter.

No one has increased their wealth because of savings account percentages.

Agreed, but we’re talking about having emergency funds that requires high liquidity, and putting them in HYSA, not your typical 0.5% bank savins account. You really wouldn’t want to tie your emergency funds to the stock market as the market is volatile in the short term, and you pose a real risk of needing to withdraw funds during a downturn.

If that’s where the majority of your funds are located, you’re wasting the money’s potential.

We’re just talking about emergency funds, not an entire portfolio.

Agreed with the rest of your points, though not sure where they come from.

We’re just talking about emergency funds, not an entire portfolio.

We’re in a shitposting sub and I started the comment thread and I disagree that anyone needs several dozen thousand in an emergency fund that is available within minutes.

Yes if you are okay with accepting market losses which could be significant. Its true that the stock market typically is seen to keep your value on track or better than inflation rate but there are risks.

Rates are pretty good right now (~5%) for a money market fund and it only takes a day or less to free up those funds and transfer them to your bank account.

If you have a 20% loss in the stock market you are forced to realize that loss if an unexpected expense comes up.

And it can be way more risky if you are doing individual stocks or pretending like you know what your doing. Some stocks go through corporate actions that tie up funds for indefinite periods, or of course go bankrupt in some situations. Monthly/daily compounded 5% return on a money market is better than idle cash but still very safe.

Bank advicers usually don’t advice people to it either, because the bank doesn’t make any money on those accounts,.

They do make money on those accounts as they only have to keep 10% of it to hand and can loan out the other 90

The European deposit protection is fixed at €100000 pr. customer instead of a percentage. They are not allowed to use customer savings for their own investment or loan outs. It’s handled completely separately…

Regardless of guarantee, the bank earns a lot more on loans than deposits, so their advisors will always try to push their loan products even when you have money in the bank. They want the customer to be in debt to them. That’s how banks earn money and always have.

The idea that a bank is some kind of piggy bank where they use customer deposits for investment is a bedside story. They loan money to loan out and then take a cut. It’s loans all the way. Banks have no interest in plain deposit accounts except for being a point of contact to the customer so they can sell loans.

Real talk? This shit is out of reach for most Americans. The best you can do is make sure you maintain a low amount of debt. It’s better to live paycheck to paycheck if it means reducing any outstanding liabilities. If you’ve got a decent enough credit score, banks’ll have no problem bailing you out of trouble with a quick loan or a credit card or a payment plan. The problem really comes if you’re already heavily making use of debt, and then something goes wrong.

Hey, college only costs s~$1000 and you can buy a “starter” home for ~$40,000. It’s possible to pay for these things with a summer job as a lifeguard. Why aren’t you happy?

- Boomers

Reality: $1000/month and $40k minimum down payment.

Because I don’t want to work anymore. :(

I’m one bad sickness or injury away from being financially bankrup

0*6=0.

Done. I’m crushing it.

I finally got up to at least three months, but then had to fill out FAFSA so I can give it all to my kids college. Back to paycheck to paycheck for me