Puerto Ricans cannot vote in general elections despite being U.S. citizens, but they can exert a powerful influence with relatives on the mainland. Phones across the island of 3.2 million people were ringing minutes after the speaker derided the U.S. territory Sunday night, and they still buzzed Monday.

Democratic Vice President Kamala Harris is competing with Trump to win over Puerto Rican communities in Pennsylvania and other swing states. Shortly after stand-up comic Tony Hinchcliffe said that, “I don’t know if you guys know this, but there’s literally a floating island of garbage in the middle of the ocean right now. I think it’s called Puerto Rico,” Puerto Rican reggaeton superstar Bad Bunny announced he was backing Harris.

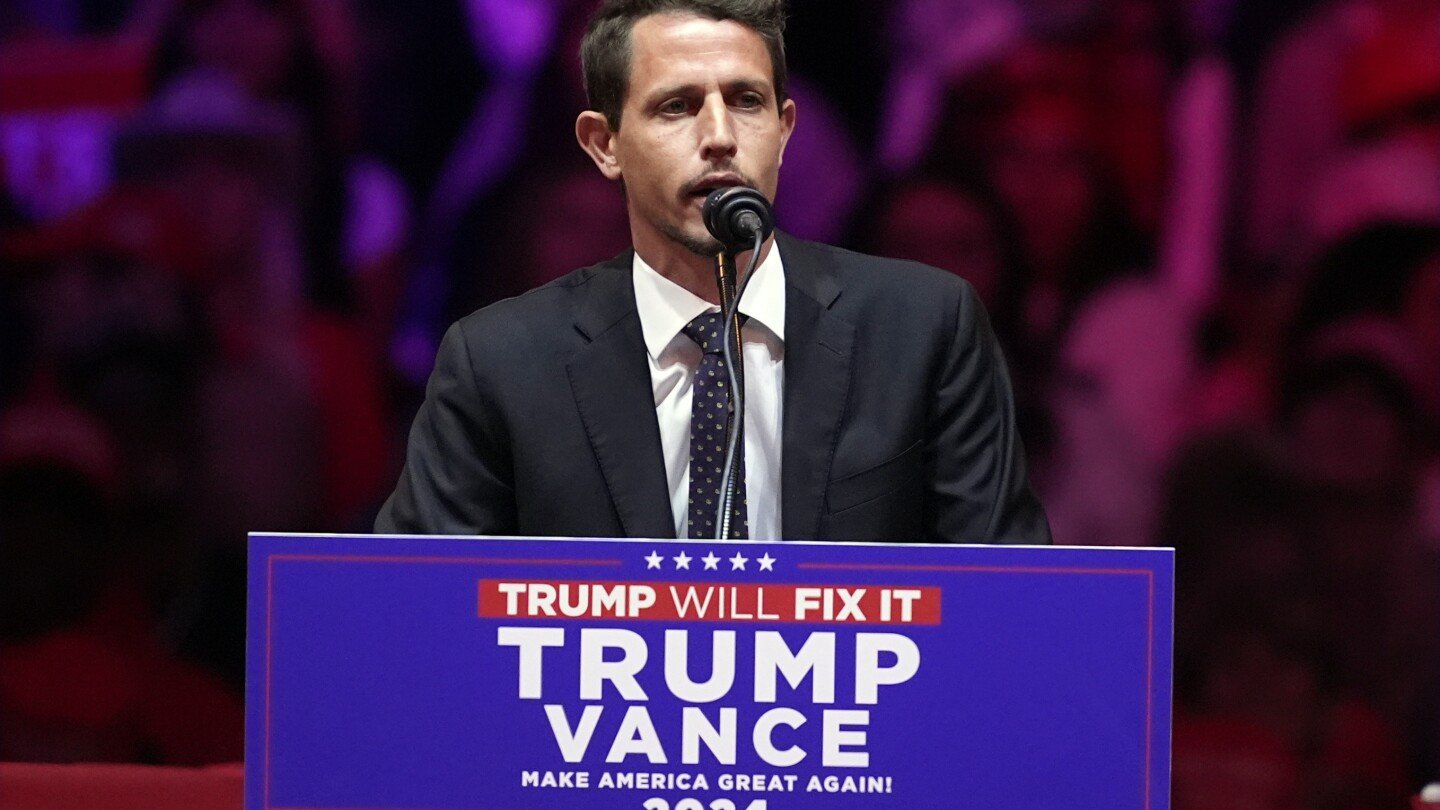

After Sunday’s rally, a senior adviser for the Trump campain, Danielle Alvarez, said in a statement that Hinchcliffe’s joke did “not reflect the views of President Trump or the campaign.”

Because each state is given the power to elect a president, not the voters. Puerto Rico isn’t a state so their voters aren’t represented properly.

What happened to “no taxation without representation”…?

Never existed in the US. Women, slaves, prisoners, permanent residents, etc… It’s always been in the hands of the rich. They just pretend to listen to the people. But as Trump has many times noted, the vote doesn’t matter. The state can send delegates with any instructions they want and the federal government can decide state delegates are not valid and exclude them. Most states have laws to follow the vote, but it’s not the federal government’s job to enforce those laws if they chose not to follow them. That would be for the people of that state to fight later.

Ask some of the 14-17 year olds working their first jobs paying tax without the ability to vote. That was never a real concern for anyone outside landowning whites.

Lots of people move to Puerto Rico for tax purposes.

Easy, they don’t pay federal taxes

While they dont pay income taxes to the IRS, they do pay customs taxes, federal commodity taxes, and federal payroll taxes (Social Security, Medicare, and Unemployment) to the IRS, which sounds alot like federal taxes to me.

It also feels like it’s something different because they aren’t supposed to go into the general fund, but advance payment for specific benefits

Do they receive those benefits?

Yes.

Taxes are just when the goverment demands money. It doesn’t require they spend (or not spend) on anything in particular.

That’s not true. There are technically different classifications. For example, fees are specifically not taxes.

Oh in that case they’re just paying the “working a job” fee. Next we should have a “using land” fee, problem solved!