I recently gave up my 3% mortgage from 2013 in exchange for a 7% mortgage. It hurts, but it was worth it to get out of Florida.

In the end, my housing costs actually didn’t change that much because my home insurance rates were skyrocketing.

but it was worth it to get out of Florida.

You could put almost any horrific thing in front of that phrase and it sound valid.

I had to keep my arm in a tub of fire ants for 5 minutes, but it was worth it to get out of Florida.

I had to cut off several limbs leading to a bad case of sepsis…

I had to sell a few children (not mine) along the way engage in some other morally questionable activities…

I had to sacrifice my first born like Abraham did his Isaac…

…but it was worth it to get out of Florida

It reads like a country song…

🤌

I could not agree more. The flip side is likely true as well…

“I’d rather put my arm in a tub of fire ants for 5 minutes than move to Florida. “

Also home insurance isn’t tax deductible (to my knowledge unless you’re renting the house and then it counts against the income you made renting) but the interest paid is.

That’s a good point, but I’m definitely paying more taxes now than I was before. My new state has income tax and tangible property (vehicle) tax that Florida didn’t have. I looked up tax distribution for my county and the majority goes into education, so I can’t complain too much.

I’m in year 17 of my 5 year starter home. I can’t afford to upgrade now. I’m gonna die in this house.

Hey, don’t be so glum. You could die at work for example.

I work from home lol

Nice, you’re both right.

Same story as everyone else. Bought pre-covid, refinanced, now sitting pretty. We desperately want to move, but I would have to make like $50k more a year for the same quality of life.

Rent it out or sell it and move. How is it not a wash for whatever u want to buy?

Because interest rates are way higher now?

I don’t know where OP lives or how much their house costs, but a $400,000 home at 3% is around $1,685/month. Same price at 7% is about $2,660/month.

If it were in a more expensive neighborhood, a $1 million dollar home at 3% is about $4,200/month. At 7%, that makes it $6,650/month. Many average houses in California can cost $1.5 million… so needing an extra $50k/year sounds reasonable to be able to move into a similar house.

You have to get a new loan when buying a different house unless you have the money to pay cash. That means you accept the current rate. I wouldn’t want to spend an extra grand or two per month on a similar house.

Kinda strange reading all these comments about how people dislike their house and where they live, but can’t imagine giving up their mortgage rate.

The almighty mortgage handcuffs, the true American dream.

Oh look it’s me. 3.125%

My wife and I LOVE our house and don’t want to leave, but we definitely thought it was going to be a starter home. We straight up could not afford the mortgage payments anywhere else at today’s rates, even in a much smaller house

Had 30 yr 3.84%, refinanced in 2021 to 15 yr 1.999%. it’s the cheapest money I’ll ever have.

2.875 here, my monthly payment is $545. I want to move, but it would be financially stupid to do so

Basically, unless the sale gets you enough to buy the next house in cash, it’s a bad idea, lol.

The value of my house has gone up by about 50% so I could definitely put the money forward, but it still would be a questionable decision.

Bought my house just before the crash in 2007. Felt screwed over as I went underwater and was stuck with my 6.5% loan while interest rates and home values plummeted (and because my mortgage was privately held, no HARP refi option.

Finally after nearly 15 years not only go out from under water but built enough equity for a no cost refinance. Got into a 2.25% loan.

Sad part is, despite the lower rate, due to skyrocketing insurance and taxes, my payment is no cheaper

Taxes and insurance is what will knock a lot of us out

Are we like not even allowed to talk about renting out our home in order to upgrade or something? That’s the play right now. Net present value of your almostfree money is maximized by turning it into cashflow. Plus you don’t blow 6% on closing costs, and it’s all the same to the bank in terms of getting another loan. It actually ends up being an equity asset as well as income.

Err, what I meant to say was murder all landlords.

It’s possible, if you have the savings for a second down payment. I’m pretty sure you also lose certain tax advantages if you convert your primary home to an income property. Depending on how long you’ve owned it, that can work out to a serious hit.

You can’t deduct the mortgage interest (you can on the new primary residence though), but suddenly every dollar you spend on the rental property is tax deductible as a business expense. And you can like deduct depreciation on the appliances and shit. It’s actually more tax advantaged in some situations.

3.25% 30 year… 27 years left.

But I’m OK staying. I’ve made huge improvements. Upgraded the electrical panel from 100A to 200A, added solar panels, added a retractible awning. Hot tub is coming.

It’s a nice house, with a good yard, will be fun to add playground stuff when we have grand-kids.

Not trying to throw shade at your shade, but I don’t think the retractable awning is building a lot of equity.

It’s a freeing feeling when you decide to put money into what you want instead of what has the biggest ROI.

It basically created a 3rd patio space.

2.75% here. Yeah… I don’t like where I live but I ain’t moving unless I have to

3.6 here (bought 22) and not fucking moving until rates are at least below 4 again. If that means I don’t ever move again then so be it

If that means I don’t ever love again then so be it

Either this is a typo or very dramatic lol.

deleted by creator

Typo but a funny one lol

7-8% rates are bad by recent standards but not awful by historical standards. Depending on where I move and how much house I can get, I’d be willing to give up my 2.9% rate for something in that range.

There are a few other factors to consider right now, anyway. I’m a Houston resident, and this is supposed to be a particularly bad hurricane season along with a historic heat wave. My wife is terrified of the state’s newest right wing legislative push, as well. Michigan, Minnesota, and Washington is looking better and better as Texas brains are poisoned by MAGA media. And, despite having a gangbusters growth, my O&G employer decided to cut our bonuses from last year - so I’ve got one eye on the job market again. Our water bill jumped by 9% in a single year. Our interior roadways are falling apart, with no sign that the city or state plans to clean them up or improve access to public transit. HISD is being cannibalized by the governor’s cronies, so I won’t have anywhere to send my kids in a few years.

Would I pay an extra $500/mo to live in a state that isn’t run by pedophiles, bigots, and zealots? Absolutely. Bonus points if it got me out of the concrete jungle and put me in spitting distance of some decent mass transit.

If those are your problems with your area then you might as well just leave the US, we’re not getting mass transit anytime soon, climate change will make weather and necessities more expensive everywhere, and fascists are one lucky election away from bringing forth Gilead

A lot of Texans are thinking about it. My mother is deeply a-political, she retired last year, but she told me a year ago that if I needed to move to the Netherlands she would move to help me. (Her grandparents were dutch immigrants, so she might qualify for citizenship where I wouldn’t.)

I suspect when rates go down, there will be a new rush for people wanting to change properties. That means new high demand for houses and another jump in valuation.

It will likely never get to 4% again unless there is another major recession or you are willing to get an ARM. Historically, 4% is extremely rare for fixed rate mortgages.

So they say but I’m 30 and have seen it twice already so…

When we were buying (2019), my in-laws were pushing for us to just get a starter home, and then upgrade in a few years. Both my wife and I were like “no, we’re buying once and being done with.” So we went a little higher than I was comfortable with.

However, our house has increased by 50% since we bought it, and we were able to refinance to 3% during the pandemic. Which was and is fantastic. But, yeah, we don’t even think about moving now.

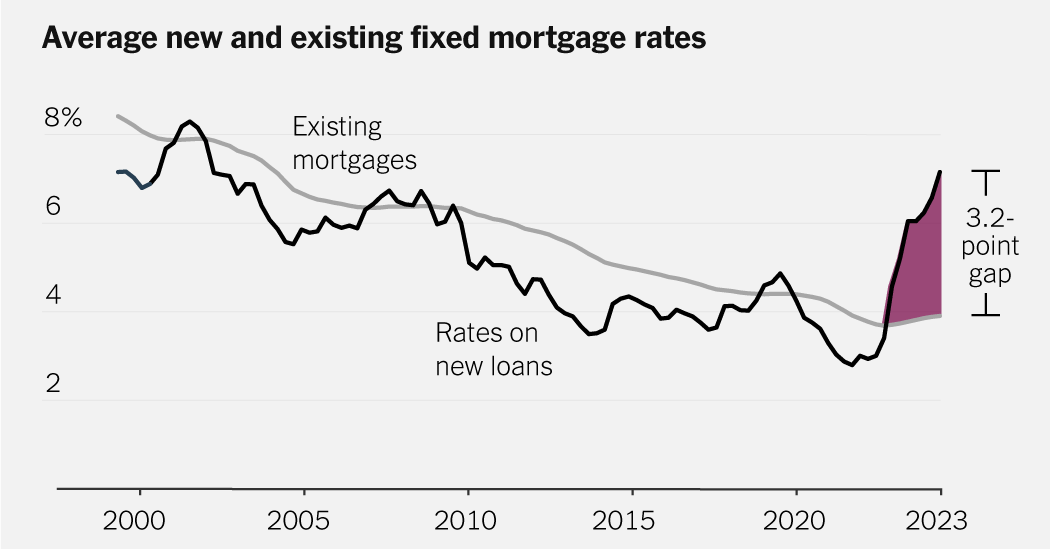

The dropping interest rate is one of the main reasons that housing prices have skyrocketed in the past 20 years. People judge housing prices by what they can afford monthly and interest rates directly impact that figure. It’s only a matter of time for housing prices to fall drastically if interest rates remain at 7%.

And yes, I have a 500k loan at 2.5% on a 30yr fixed mortgage. Maybe we’ll sell our house in 15 years, but otherwise, forget it! I have zero interest in paying it off early.

Actual deflation is unlikely. You might see a kind of stagflation where prices drop relative to real inflation, but an actual widespread drop in home prices has literally occurred once in the past hundred years, and that was in 2008.

In my area prices are already down 30%. Every chart clearly shows the falling value.

My wife and I were lucky enough to be able to purchase a home at a decent rate and then refinance a few years later to an even better rate (around 3.5%). We bought in 2019, when the world was still somewhat sane. The thought of trying to sell and get a new home at the higher rate makes me sick to my stomach and I feel bad for my brother-in-law.

We bought in 2016 with 50k down at 3.5% and our payments were $2,800. We refinanced and now our payments are $2,400. Zillow says if we bought our same house today, at today’s rate with the same amount down the payments would be $7,700, an utterly unfathomable amount.

I told my cousin to pick up a condo he liked in 2019. His cheap ass decided to wait. The condos in that building more than doubled in price and the rates tripled.