[Mortgage Is ‘Just A Fancy Bullsh*t Word For Paying Rent For 30 Years To The Bank,’ Says Real Estate Billionaire Grant Cardone — Here’s Why Renting Could Be A Better Financial Move

](https://finance.yahoo.com/news/mortgage-just-fancy-bullsh-t-171148202.html?guccounter=1)

He assumes an average monthly rental cost of $1354, and 3% rent increase annually. I have lived in apartments where they increased the rent 10% one year and 15% the next.

Even putting that aside, ok, by the time you’re dead, say it works out to the same amount spent. But as an owner, you’ve now invested in a generational asset. Renting now means your kids and theirs will also likely rent.

Gtfo.

You’re forgetting that elder care will eat up that wealth.

What pays for the elder care without that wealth?

The state subsidizes their nursing home. That article is false at least in my state.

They do that here in Australia too (probably better than the USA) but there are way more people seeking placement in aged care homes than there are beds available. Waiting times are in the years and so people end up on the street. Especially with the way rent and cost of living is these days. Government pension doesn’t pay enough to rent anywhere.

Even if the subsidise, they still have to find something open in their price range.

The highest population experiencing homelessness is boomers and more and more of the elderly are on the street now.

At least they can sell the house. /s, but not.

My rent has gone up at least $50-$100 a year when renewing my lease since I’ve been an adult renting a residence. In 2015 when I got my first apartment it was $750/month, utilities included except for electric and internet. 2 apartments later and an increase every year, I’m paying $2,000 month plus all utilities and fees for trash. It ends up being like $2350/month all said and done. And sure it’s a nicer place, but it’s not that much nicer. I’m so thankful I don’t have kids, because I can’t afford to feed myself, let alone children. I don’t know how parents are doing this right now.

My mortgage is about that, on a 3 bedroom home, because I was fortunate to buy it in the mid-10s before prices in my area went insane. Our original mortgage was about $1150, but it’s gone up $200 due to property taxes over 8 years. This averages an increase of $12.50 per year, but I know people whose rents have increased by $200 in a single year in my city. Getting a fixed rate mortgage (and refinancing when interest rates are low) is so much more stable than renting

“Freedom is overrated, people are happier when they pick cotton.” Slave Owner

owning several properties for renting and not needing to actually work is the real fancy bullshit.

did anyone tell that to this leech?

“I love renting. I never have to fix anything that’s the landlords job”

To

“Landlords do NOTHING”

In a few short years.

Tenant: “Hey landlord, my furnace isn’t working anymore. Fix it please.”

Landlord: Makes one phone call to a contractor and uses 10% of this month’s rent to pay them

My landlord makes maybe two phone calls like that a year, and she will have “earned” $40,800 of my money. Somehow, people like her have convinced people like you that simply owning a home that and doing 1 hour of cumulative work once a year is worth 30% of an engineer’s income.

Fuck off, leech.

I’m honestly just gonna block this guy, I recognize the username and after scrolling through his comments it appears I’ve downvoted him many many times

Give me a rental with a fixed monthly price for 30 years and I’ll consider it.

Yeah that goes down as keep paying it and can be leveraged against your debt, and is designed so you don’t have to pay rent when you’re retired

Also with a refund if you move out, in fact often giving you more money than you paid.

Fixed-rate mortgages are quickly becoming a thing of the past as well.

Source?

Just another ladder pulled up as we reach it.

If we built enough, this would be the end state.

Oh, I have something to say about this.

About 7 or 8 years ago I bought my house. I had friends of mine showing me articles that basically had the same “renting is better than buying” message bullshit.

You don’t really need much brain power to understand that is absurd. Paying loads amounts of money for something that will never be yours is obviously stupid in the long term.

The thing that made me very upset at the time is that my friends drunk the cool aid of these very same article and didn’t buy a property when they had the chance… Now, 8 years after, they are all struggling to buy properties except now is a lot more expensive.

The house you live in should be YOURS and no-one else.

Bought around 7 years ago as well, got told the same things. I said I was taking a bit of a cost hit now to lower my costs in the long term because my mortgage payments will never go up the way my rent payments were.

Fuck me I had no idea things would get this bad, and boy am I glad I got into a home when I did. It really shouldn’t cost that much to rent, this shit is absurd.

I agree that it’s better to own for 95% of the cases, but some of these people talking about renting being best might have been through the '08 crash. With China having their own financial crisis, we could be in a bubble because they invested a lot in US real estate. If your underwater in your mortgage (your mortgage is higher than it’s worth), you do feel like you’re drowning.

I’m not trying to scare anyone, but there is no guarantee that anything stays the same. I also hope people who are buying for the first time understand the different types of loans and they should 99% of the time want a fixed rate.

In a very specific scenario, with a very large amount of running the numbers, as a high income person with low personal expenses and a very good investment advisor, I could see how in certain situations/locations where mortgage rates are much higher than rental rates, that you get better fiscal results investing than paying that mortgage. That was a very rare situation 7 years ago, even more rare now. Where I lived ten years ago, I could not possibly afford the mortgage but I could the rent. These days there the situation has reversed and they’re both sky high regardless.

In any ideal scenario, renting would be preferable to buying for the vast majority of people.

The reason buying crushes renting, in terms of value, is that the value of housing (and thus the price) continually rises. Homeowners get equity and renters get fucked.

This happens because we literally are not allowed to build enough housing. This makes owning a home an investment.

I’ll give you three guesses as to what bloc of voters instituted those restrictions, and continues to fight for them today.

We are in the actual thread that tells you why there’s a problem, it’s corporations and investment funds buying up all of the available supply. We might be tight on supply if we got rid of all of them doing that, but it wouldn’t be a crisis.

Buying up supply happens because of what I described above.

If housing isn’t the most reliable investment you can possibly make, then there is less incentive to buy up all the housing.

This program is fine. Whatever. Every little bit helps and I’m not looking a gift horse in the mouth. But it’s a band-aid on a bullet wound

We might be tight on supply if we got rid of all of them doing that, but it wouldn’t be a crisis.

This, however, is flat wrong, because the crisis preceded the investment

I think you might be having a math problem.

Corporation Plan

- Step 1, US has a financial meltdown

- Step 2, corporations buy up all of the housing at cheap prices, price fix the rentals and use a shit ton of them for airBNBs

- Step 3, not worry about the empty units or homes because price fixing and airBNBs will fix that

- Step 4, develop a crowdfunding site so “investors” can get in on the renting/price fixing game

- Step 5, complain that there isn’t enough housing to get the zoning changed, so they can build “luxury” apartments where they continue to price fix or rent out to tourists/business people because they’re ToTALLy NoT A hoTEl!

- Step 6, profit, profit, profit

Common Person Plan

- Step 1, look to buy a home but there’s not enough supply so the prices go up

- Step 2, try to save but their rent keeps getting raised because it’s being price fixed and there is a lack of supply (sometimes real because of the tourists)

- Step 3, continue to rent while nervously waiting to try and build up a deposit and there’s less and less supply

- Step 4, rent, rent, rent further away from the city core

I really don’t because the economics here doesn’t change. You’re just trying to moral high-ground economic concepts, which isn’t useful for policy solutions.

It’s good for rhetoric tho, and we need to change minds, so it’s not a total waste.

You’re just trying to moral high-ground economic concepts, which isn’t useful for policy solutions.

What moral high ground? It’s easy to fix, make it so corporations can’t own more than a certain amount of units and corporations in general as a percentage of units in a city. If anyone has more than 4 airBNB units, you have to become a hotel. Simple solutions that won’t catch every instance but will make a dent.

“corporations bad” is a moral stance. It’s irrelevant to the underlying economics

We aren’t debating policy. we agree on policy.

I suppose my ideals are different: in an ideal scenario, I think buying is preferable to renting. But besides the problem of having enough money to get started with buying, renting gives a flexibility and reduced (outsourced to landlord) responsibility that’s very valuable for many people, especially in the short term.

By “ideal scenario” I mean a situation in which home prices do not reliably go up every single year forever

Well, the thing is you never really own it. Don’t pay your property taxes and insurance, see what happens.

Buying makes sense if you’re going to leave that property to children or relatives.

“Renting makes me money.”

Okay, work backwards from there.

FFS these people.

If renting doesn’t make sense at half of what it costs to pay the mortgage, how does the mortgage make sense

Where on earth is renting cheaper than a mortgage?

Let’s say it’s in Orange County where the house is $800 grand," Cardone said. "You’d have to sell the house for $2 million just to pay the interest bac

As opposed to paying even the same in rent, where you get NONE of it back?

assuming a 3% annual increase in rent

Lol, what planet do they live on?

On that 800k house, it takes a little over 30 years to get 2 million out of it if the house appreciates at 2% per year. Housing in many places has appreciated much faster than that (much faster than the market or any other single thing, including cryptocurrency)

And this is why we have a housing shortage. Because it’s in the financial interests of owners to restrict the building of housing.

In high CoL places, rent is routinely much lower than a mortgage— not to even mention the incredible down payment that you have to get the loan in the first place.

As an example, a one bedroom apartment in SF would cost you around $1,000,000 to buy. If you somehow have $200k to get a mortgage, your monthly payment is about $6k. To rent that same apartment, you’d only (lol, only) pay ~$3000-4500.

On top of this, the cost of owning is higher than just your mortgage payment. Your lender will most likely require homeowners insurance which can easily run a few thousand dollars per year (compared to a couple hundred for renters insurance). You also have to pay for the big repairs yourself when as a renter if the heat breaks that’s the landlord’s problem.

This is me. I live in LA, near Hollywood. I pay 3k/month in rent for a 1200sq ft 2br apartment that’s close to everything.

A condo similar to my apartment (it was a condo conversion of a building similar to mine) in my neighborhood sold for almost a million this past year. That’s about 6k/month all in w/ taxes and whatnot, not including maintenance costs.

Why the fuck would I pay double to own the same thing, and lose all my flexibility, when I take that 3k difference every month and invest it. Which builds wealth too. Sure, my investments may not be as inflation protected as a home, but they’re a lot more fucking liquid. And I can move in 30 days no unsold house hanging over my head.

In Australia and most developed cities in Asia rent is cheaper than a mortgage.

Do mortgages function the same in those Asian cities?

I mean you could compare the ‘monthly payment’ on Jenose in Korea but it’s not the real number. It’s not comparable.

This is not correct for Australia.

I’m looking at places in Melbourne at the moment. A 1-bedroom place is around $450 a week or $1800 a month roughly.

You can easily get a cheaper mortgage than that for a 1 bedroom place. Potentially even get a 2 bedroom unit for same as you’d pay in rent.

Every time I see articles about this my knee jerk reaction gets more and more unhinged. Regardless, the world would be a better place if people like this were dead.

Thats the nicest way to say it. These people fucking suck.

They’re living piñatas and it’s time to pop em.

And he personally owns how many houses?

And coincidentally wants people to rent them.

To be fair, I doubt he has mortgages on any of them, so while he may be a dumb asshole, he’s not being hypocritical here.

This is not the first time I’ve seen media stories within recent years pushing this idea that renting is better than buying.

This is the absolute stupidest most transparent lie the rich are trying to pull to fuck us. Sure we don’t see all the shady shit with lobbying and and all the details of inflation bullshit. Those are easier to keep mysterious and hide the exact details.

But this rent thing, that’s the dumbest most demonstrably false lie they have ever tried to spread. If anyone is believing that shit, god help them.

We bought our house seven years ago. If we were to sell it today we’d make almost as much in profit as what we paid for it.

Very similar situation here. It was a huge stretch to get it, and I was skeptical, but my partner pushed hard for it and everything got better after we got a house.

Nevermind that we put all of our consumer debt on the mortgage when we renewed, even our mortgage payments are by far lower than anything you can get in town.

It’s crazy seeing materially, exactly how greedy landlords are when I friend of mine in a tiny two bedroom is paying almost double what I pay the bank for a whole ass house.

Apparently equity is not worth mentioning.

deleted by creator

To me, the big draw to renting is the flexibility. It’s easier to move if you find a better deal elsewhere or you need to move for a job. It’s especially attractive in many European countries where a lease is “unlimited” and doesn’t run out unless you cancel and there’s only a three-month cancellation period. Makes it very flexible.

A bit different in the states where the lease term is set, usually at one year and then you renew and have to pay to break the lease if you move out before the end of the lease. But still more flexible than buying.

A quick sale is much more involved and risky, imo.

I think we should conquer his mansion and turn it into a commune.

His massive wealth is “fancy bullshit”.

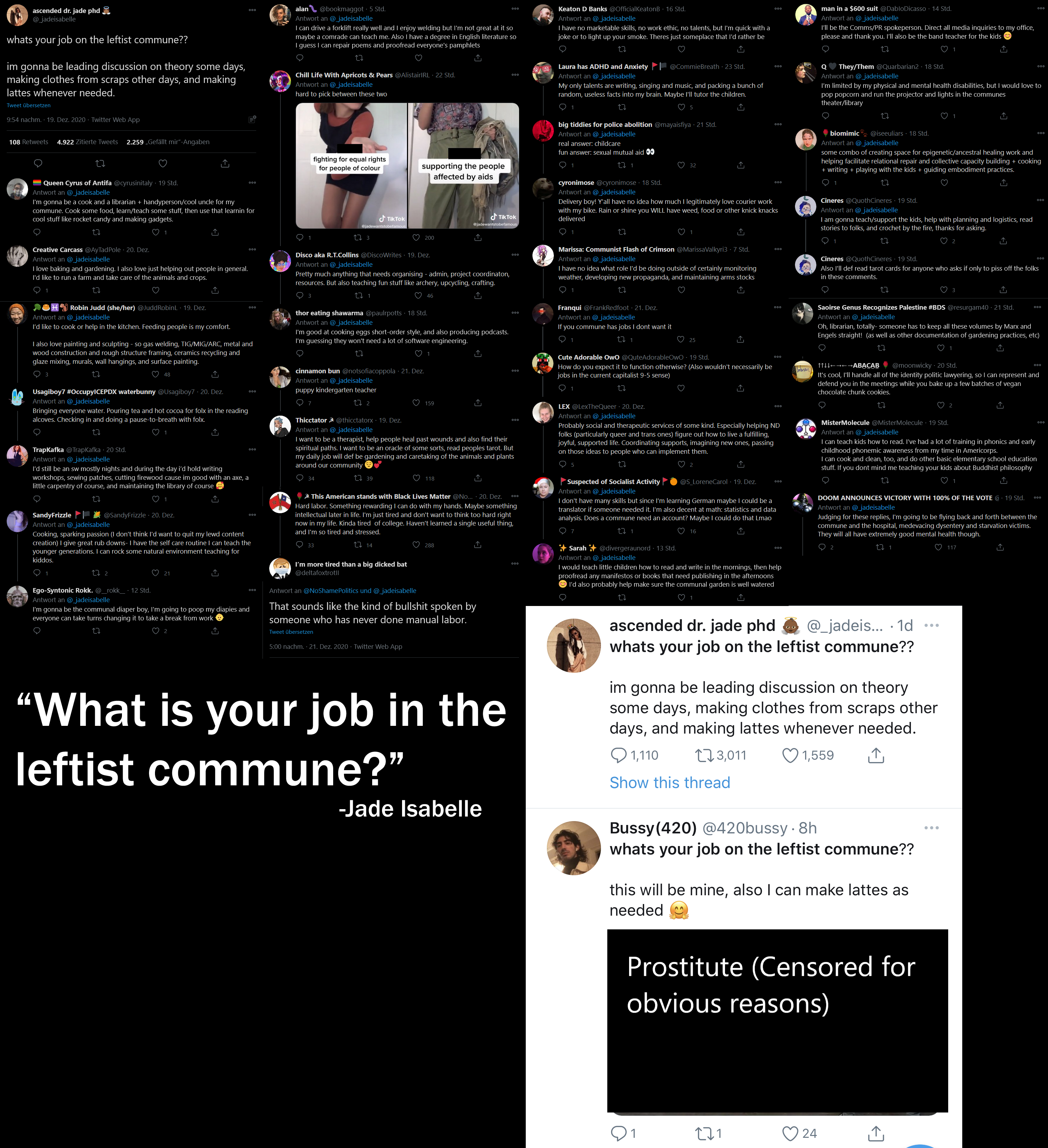

But what will your job be on the commune?

That’s hilarious. One gardener and a bunch of people doing fuck all

I call being the dictator, once the revolution is complete I pinky promise I will step down

deleted by creator

But #LandlordLivesMatter!

Fuck em.

You’re paying for a service that provides you a place to sleep for a term. The deal the landlord has with the bank is none of your business.

Many large rental companies don’t even have mortgages. They pay cash for what they buy. So your statement is extremely ignorant.Yes landlords are famous for renting at a loss…

Of course the amount of money that would go into a mortgage payment would go into rent. If they pay cash up front, they have a projected timeline to recoup that investment. The details about whether it’s technically a mortgage payment is immaterial, the reality for the resident is that rent is higher than a comparable mortgage payment would be.

The only difference in amount is that the rent pretends the mortgage is infinite term, rather then rent getting cheap after the purchaser has recouped their purchase expense.

Aight let’s see. Mortgage is a fixed rate over an agreed upon term that ends with you owning the property, rent increases every year, you have no control over the property and you get fucked constantly.

Yup, totally the same thing.

Also my mortgage for my 1/2 acre property with 1500 sqft house is $50 less per month than my 900 sqft poorly constructed “high end” apartment rent was about to spike up to. You know, after renters protections were removed during the pandemic.

Quick edit: furthermore, it took me until I was 30 to buy a house. In that time I spent 170k in rent, when I started renting the property I’m currently living in was worth 140k. That’s pretty easy math right there. Just like… Come on.

But… but… but you still have to pay for maintenance and repair.

Ok I’m half kidding, given you still have to pay those things but depending on how the math works it can still be cheaper to own.

It’s always cheaper to own given you live an adult life for at least like 15 years. The rub is whether or not you can afford the upfront costs to get a property.

Also you pay for maintenance and repair and taxes and all that nonsense in your rent, it’s just one bill instead of multiple.

Housing can’t be both an investment vehicle and affordable. This guy is essentially saying “let’s just nix the affordable part”. Absolute vampire.

He’s literally one of the people making home ownership unaffordable.

Yeah but at the end of 30 years the bank lets me keep the place and they never raise the price

As long as you pay the property tqxes and homeowner’s insurance, and all the maintenance.

Don’t forget the last 5 years is u basically using the banks money for free cuz of amortization.