Fuck all corpo scum! Intuit, TurboTax and H&R Block can all fuck right off! Corporate lobbying motherfuckers can burn in hell.

I filed for free with H&R Block.

…And Now you can file for free without them

And your financial information need never leave the IRS and be put in the hands of a private company.

a private company would never sell this data

No no, some of us enjoy struggling through page after page of attempts to push premium products and services, and never mind that these “free file” options generally don’t cover both state and federal. But hey, yay for H&R, they really need the business, right?

I had to mail in my state taxes for NY due to NYC regulations, which I didn’t know about since I’ve been using TurboTax for 7 years. I was only informed of this after I had filed my taxes federally using the IRS system. There is no way to just file your state taxes online, you have to do both and if you submit them a second time it just gets rejected.

It’s good that they’re doing this, but it caused a lot of headaches for me that I was unaware of.

Yeah but now H&R has all your financial information. It’s “free” but that doesn’t mean there is no cost.

I filed free with TT. But, will definitely plan on using the IRS system.

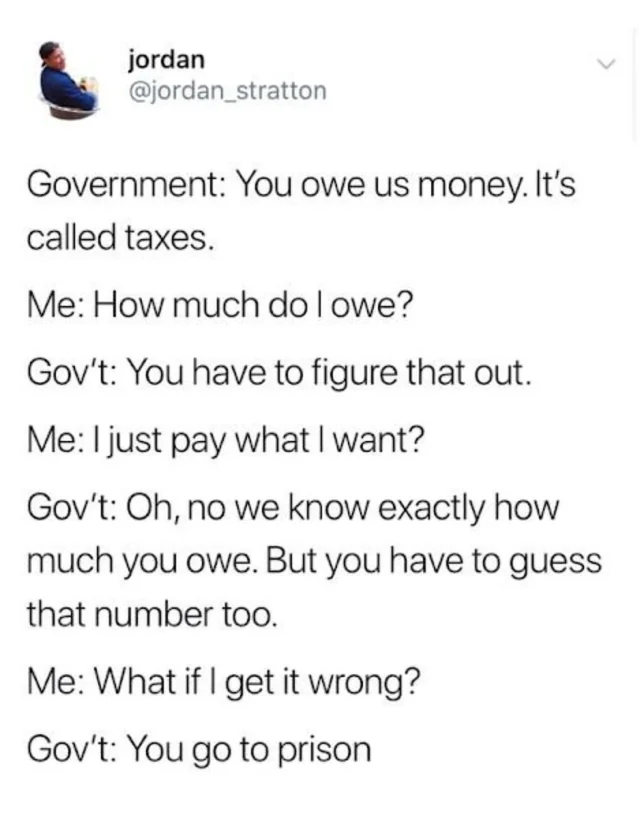

Old meme, but (1) you don’t go to prison for making a mistake on your taxes in America — you have to do a big fraud (2) no, the government doesn’t always know how much you owe, they only know stuff like domestic W2s and what banks file. There is a huge amount of ways to make income outside of that

I’m guessing 50% of individuals would be covered by just those 2 methods. Other methods would quickly follow once people realize how the rest of the world does not cater to crazy and the ones they can legally bribe (“lobby”).

It doesn’t matter if 50% of people would be covered by the information that is submitted to the IRS, the point is the IRS does not know that. when you do your taxes, you are telling them that there’s nothing else, but until you filed, they could not assume it.

And it isn’t just about the lobbying, it’s also just about conservatives in general. They do not want the government getting maximum tax income. They have crippled the IRS countless times over the last couple of decades, choking off their ability to ensure the government is getting the tax money it is owed. It doesn’t matter what new methods could be employed to ensure that nobody ever had to file their own tax returns, the point is the IRS is not funded and staffed enough to manage that.

The IRS doesn’t actually check most tax returns. They audit a certain number randomly every year, but they don’t check them all. They can’t with the resources they have available. They are taken on good faith for the majority of Americans every year because the IRS can’t check the sheer scale of them in a timely manner. If something looks really off, so much so that it triggers something in the system, they’ll take a look, but for the most part they’re trusting the fear of an audit to keep people honest.

Keep in mind that the majority of the countries that you’re referring to are dwarfed by the US. It is substantially more complicated and more expensive to manage federal income tax returns for all 50 states than it is for, say, Germany.

I feel you’re kinda talking past ChapulinColorado’s comment. He’s indicating that for many people they would should have a simple tax filing process where they don’t receive money outside of what’s reported to the IRS already. Many workers only have a W2 and use the standard deduction. They shouldn’t have to pay a 3rd party to get their taxes done, and it shouldn’t take them almost any time to file a return.

yes you’re also right that people would still need to confirm what their income is (especially if its not reported to the IRS), but that doesn’t apply to a large section of the US Population.

The IRS doesn’t actually check most tax returns

That isn’t true. They check all tax returns based on W2, 1099’s and other documents they receive from corporations that paid you money.

An audit is completely different from the automatic checks that make sure every bank record of interest and stock sale lines up with what you claimed on taxes.

If you miss any stock sale or any reported income, you will get a computer generated letter from the IRS for the amount you owe. If you pay too much by accident, you will also get a computer generated check back from the IRS.

I make a mistake every few years and get a bill with fine or a check from the IRS. I no longer stressed about taxes because I know they will correct it for me in a few months anyway. The fine is small because I’ve luckily never made a big mistake. I’ve gotten back large checks for years I forgot I paid estimated taxes and overpaid my taxes.

I am aware of all of those points, the thing is people try to make excuses for why we can’t follow the rest of the world and expect some perfect solution day 1, which will just hold us back. Gotta start somewhere.

For the first point and point about audits, can still be handled as they are now, send people a w2 and bank reported prefilled form, ask them to add anything missing. Same as now, but less energy required to start or complete the task for most people. Kind of how most tax programs start your State income tax forms with the information entered in the federal one and what was declared the previous year which is already known and go from there.

I remember people saying that Lemmy was going to be better than Reddit, yet here we are, with idiotic memes sharing blatant falsehoods that pander to people who can’t be bothered to think critically or actually learn anything. Upvoted straight to the top, not least of which because it’s an image.

I miss old Reddit when, if people were going to say stupid shit, they actually had to take the time to type it.

I don’t like you.

Reddit has been the same since day one. You’re just being dramatic. They had plenty of stupid and off the wall shit that went just as this has. You’re being ridiculous old timer.

What’s the blatant falsehood? You are required to calculate taxes that the government largely already knows the answer. If you calculate wrong, you get a letter from the Government telling you where you were wrong which proves they knew the correct answers all along. If you don’t pay that fine, the end result will be prison.

Our captured Gov’t: You go to prison…unless you’re very wealthy of course, this is America after all.

Then we’re happy to negotiate, settle, reduce, and otherwise facilitate your repayment in a way that’s convenient for you and your tax litigation team, sir!

Step in the right direction either way. Hopefully this means they’ll be capturing metrics on which parts of the process are the most complicated and improve those areas.

*US Gov’t

It’s so weird to read a positive headline. :)

TurboTax for bankruptcy, LET’S GOOOOOOO!!!

Wait asking the states to allow this? Great means all the red states like the one I am stuck in will opt out fucking us over.

Don’t fool yourself, there’s a lot of Democrats in the pocket of the tax prep lobby.

Dark Brandon’s war with TurboTax has only just begun…

It’s kinda wild to see things moving in the right direction for once…

It’s almost like, I don’t know, Biden is helping. But both sides bad, amirite?

Yes, both sides bad, but Biden less bad. Making government easy to work with should be the bare minimum. We don’t have to throw them a parade every time they do something sane, they work for us.

Right? I almost can’t totally believe it, I’m not sure if I should

deleted by creator

Any takers on what party of small government will try to dismantle this?

You want a Biden TAX PANEL to decide if your grandmother has to pay or not? We will defend your right to choose the tax prep service of your choice!

“Tax preparer vouchers!” GOP, soon

Wild to read how the US tax system works when you’re used to the EU.

Maybe one day you’ll also get automatic tax filling without lifting a finger.

Then how would you arbitrarily fine your citizens?

Dearest American friends,

I’m happy for you. Given your tax system this seems like a really positive step forward.

I hope it makes your lives better.

Does this include state taxes?

The agency also is inviting all states with a state income tax to sign up and help people file their state returns for free. During the 2024 pilot, tax agencies in Arizona, Massachusetts, California and New York helped people directly file their state taxes.

I live in Massachusetts and I used the IRS free file service this year, for both state and federal taxes. It was a very painless process, and I had my federal refund in my bank account in less than ten days!! It really works.

I signed up to do the free IRS filing but got rejected unfortunately because I had entered into a domestic partnership which made me ineligible. Not really sure why since I was filing single anyway but oh well, this is good news and I can’t wait to try it next year.

The test was limited to make sure the core fundamentals worked. Your situation is an “edge case,” i.e an unlikely situation that makes things much harder to code.

It sounds like they cut you out to make sure the product worked, and will now be on working “edge cases,” by far the hardest part of any computer engineering.

I’ll be the contrarian - this could be good for Intuit.

They were already forced to support free filing for simple returns. This IRS Direct File has similar eligibility, so Intuit already wasn’t making money off them, but now Intuit also doesn’t need the cost of scaling up for them

Intuit gets to take a bunch of freeloaders off their support costs, and can focus where their real profits are: people with more complex returns or higher income, that also don’t need an accountant

Intuit also gets to act less scammy. The only way they were making anything off those freeloaders was selling them things they don’t need

They made money off upselling people who thought it would be free. Or another way was to wait to tell them about the charges until you’ve spent a couple hours on the application. …or the way they would sell you last years tax information back to you to save you a few hours filling out forms.

United states of monetization.

Well you can also do what I do which is select the most expensive options. Figure out everything then copy the details onto a free file option and never pay them.

Appreciate the tip!

WhAAAAATT! wow that is amazing great news. Holy shit!

This is HORRIBLE! I absolutely can NOT stand ANYTHING that makes Biden look good!

-Republicans who care about the Economy and the Country.

How about return free filling… Why the hell do we have to do anything at all?