One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

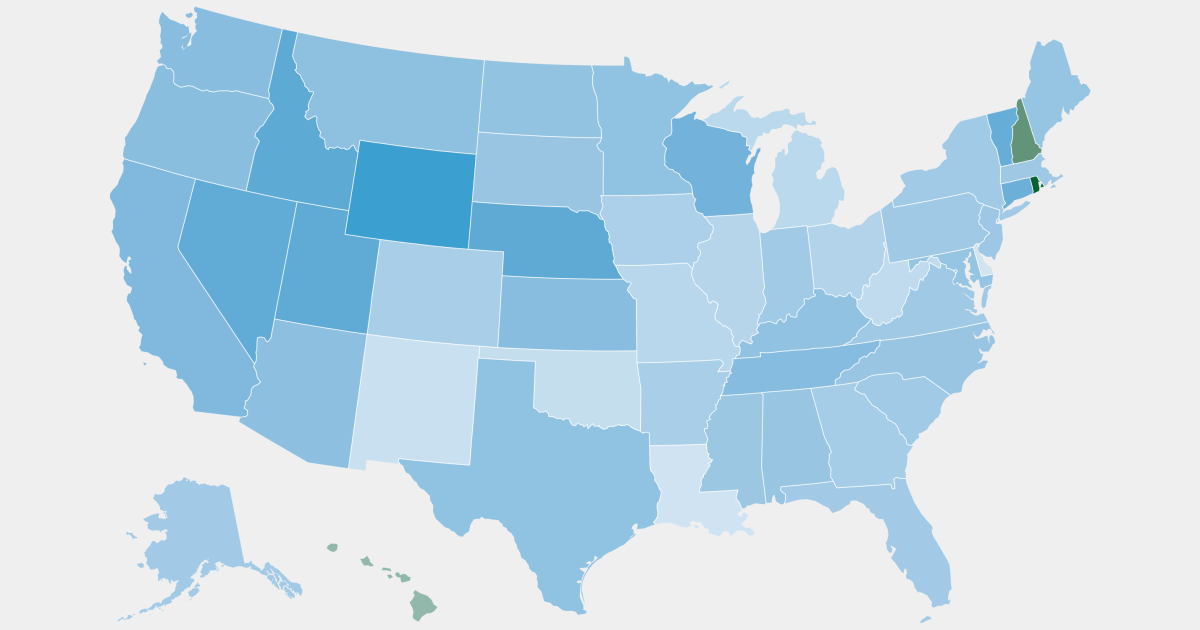

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

When buying our first house in 2008 the mortgage company was pushing us to buy more by saying, “why are you purchasing this house at $197,000 when you can afford twice that?” My response was, “we’ve done the math, we can’t afford twice as much.” Never listen to a mortgage broker. They all want you to spend more so they make more.

I bought in 2022 and can’t imagine having that much interaction with a mortgage broker. My interaction consisted of giving them my information. Getting pre approved for a stupidly large mortgage (about twice what I could afford). Then, when I found a place to buy, they punched in the address for the “virtual appraisal” and approved the loan.

I had the exact same experience a few years ago. A lender did some quick math within like 20 minutes of talking and was like “I think we could go ahead and lock you in at loan in the mid 600’s”

Lmao we could never in a million years dream of affording that. Idk wtf that dude was thinking but I can’t even begin to try and figure out how I’d be able to afford that mortgage unless it was like a 3,000 year 1.08% loan or something.

The amount I “qualified for” when applying for a mortgage was fucking insane. I would be completely under water if I had taken the bank up on that full amount. I assume plenty of people jump at the chance to spend huge piles of money they don’t have and will likely never have.

Exactly this. I have pretty much the same exact story from that same time frame! Now my house is paid off, so I’m glad they didn’t tempt me.