The new Cold War is a business opportunity, and Mexico looks better placed than almost any other country to seize it.

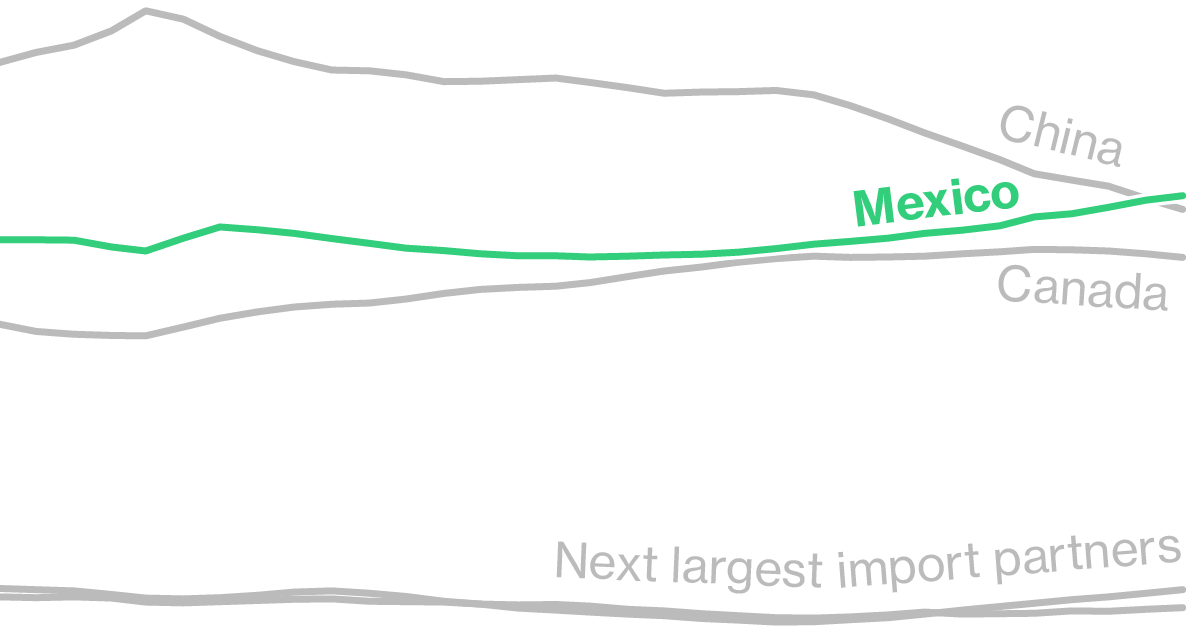

US-China tensions are rewiring global trade, as the US seeks to reduce supply-chain reliance on geopolitical rivals and also source imports from closer to home. Mexico appeals on both counts—which is one reason it’s just overtaken China as the biggest supplier of goods to the giant customer next door.

On top of resurgent exports, Mexico boasts the world’s strongest currency this year and one of the best-performing stock markets. Foreign direct investment is already up more than 40% in 2023, even before Tesla Inc. starts building a proposed $5 billion factory. Not since the signing of the North American Free Trade Agreement in the 1990s has the country held the kind of allure for investors that it has right now.

Removed by mod

Good analysis. Although one thing to note here:

The net migration rate of Mexicans coming in and also leaving the US is fairly stable and has been for a couple decades. The main source of inmigrant for the US is Central American countries. But your point still stands that a stronger Mexican economy likely means less immigration to the US from those nations since it would be easier to simply go to Mexico where they speak the language.

Removed by mod

It’s because the US dollar is currently worth 17.14 Mexican pesos, and currently worth (as an example) 7.87 Guatemalan dollars, meaning they are functionally making less money in Mexico.

Keep in mind a lot of these migrants are men who send money home to their families, so exchange rates matter hugely.